Casinos have historically been at risk of exploitation by those seeking to launder criminal property. We look at five things you need to know about the problem, rules and changes to sector guidance.

1. Why is this important?

The nature of services and products offered by the gambling industry can make it attractive to criminals seeking to launder or disguise the origins of criminally derived funds. Significant risk factors in this industry include the prevalence of cash transactions, accessibility to multiple premises and anonymity on the part of the customer.

2. Who is covered by the rules?

When lawyers representing the casino operator told the NSW Casino Inquiry that there was a good chance criminals used the properties to launder money, it was a further nail in the coffin. Methods of money laundering. Money laundering is an extremely broad crime that can occur in countless different ways. In Nevada, one of the most common money laundering schemes involves using casinos. Reno NV criminal defense attorney Michael Becker gives an example: Example: Sam robs a store in Henderson and takes $10,000 from the register. Casino Money Laundering Was Out of Control, Cullen Commission Hears Some of the instances mentioned in the reports show that a single casino high roller was able to introduce a buy-in amounting to CA$900,000 in cash. This happened over the course of one day and casino management saw nothing suspicious about it. In addition to the civil money penalty, the casino is required to conduct periodic external audits to examine its anti-money laundering (AML) BSA compliance program and provide those audit reports to FinCEN and the casino's Board of Directors.

New anti-money laundering provisions relating to casinos were brought in by the Money Laundering Regulations 2017 (MLR 2017) on 26 June 2017. A key change is that all casino operators, both remote and non-remote, are now caught by MLR 2017, rather than simply holders of a casino operating licence. A remote casino operator will be caught by the MLR 2017 if they have at least one piece of remote gambling equipment situated in the UK or if the gambling facilities provided by the remote casino are used in the UK.

This means that non-casino gambling providers, such as betting shops, are not covered by the MLR 2017.

3. What are the rules?

Under the MLR 2017, casino operators have a legal obligation to do the following: Igt slot machines how to clear codes.

- Risk assessment: conduct a written risk assessment in respect of money laundering risks faced by the business and ensure that there are adequate procedures in place to deal with those risks.

- Customer due diligence: conduct risk based customer due diligence (CDD) when they:< >establish a business relationshipsuspect money laundering or terrorist financingdoubt the veracity or adequacy of documents or information previously obtained for the purposes of identification or verification.Nominated officer: appoint a member of the firm as their nominated officer (i.e. outsourcing is no longer possible) as well as a member of the board of directors (or equivalent) as the officer responsible for compliance.

- Reliance on third parties: accept ultimate responsibility for compliance with MLR 2017, even where they are entitled to rely on CDD carried out by third parties.

In July 2010, the Gambling Commission, which oversees the casino industry's compliance with their anti-money laundering obligations, published a guidance note entitled 'Money laundering: the prevention of money laundering and combating the financing of terrorism: Guidance for remote and non-remote casinos' (PDF). This guidance was updated in 2011 and 2016 following changes in the law.

4. How are the rules/guidance changing?

In light of the changes brought about by the MLR 2017, and also the Criminal Finances Act 2017, the Gambling Commission's guidance note has been revised to a new fourth edition to assist casino operators in complying with the latest requirements. The updated guidance went out to consultation in July 2017. Responses are sought by 8 September 2017.

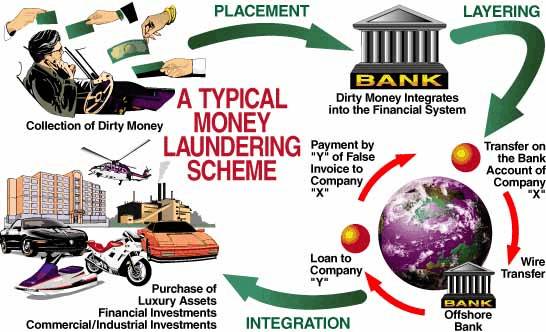

Casino Money Laundering Explained

The consultation document invites feedback on the above amendments and, in addition, asks for views on whether or not the Gambling Commission should remain the sole supervisory authority for money service business activities provided by non-remote casinos.

5. What can casino operators do to comply with the amended regulations?

Casino operators can ensure they have effective anti-money-laundering and counter-terrorist financing measures in place by taking the following steps:

- Risk assessment: review and revise the risk assessment, covering issues such as customer profile, premises and remote sites and incidents of actual or suspected attempted money laundering.

- Policies and procedures: review and revise policies and procedures in light of the identified risks. Ensure that the policies and procedures are properly disseminated and appropriate training is provided on them to front line staff.

- Senior management commitment: senior management must be fully engaged in developing and maintaining procedures and controls which are necessary to manage the risks identified in the casino operator's risk assessment.

- Record keeping: keep records of all anti-money-laundering policies, procedures and controls and all ongoing transactions with customers. Records of CDD identification and verification must be maintained for at least 5 years.

- Suspicious activity reports: providing appropriate training to all relevant employees to enable them to make a report where they know, suspect (or have reasonable grounds to know or suspect) that a person is engaged in actual or attempted money laundering or terrorist financing.

Is your casino operating in the European Union or in one of the OECD Country?

Most of OECD Countries, including EU, USA, Canada, and Australia have adopted Anti Money Laundering Law.

European Union IV Directive EU 2015/849 about the prevention of the use of the financial system for the purposes of money laundering introduced an incumbent compliance requirement and very soon all National Governments of EU Countries will adopt a National Law to enforce European Union Directive and therefore all casinos must be compliant to AML Law.

Having a robust AML strategy and procedure and/or better installing a technological integrated system to detect and prevent Money Laundering illegal activities, methods and techniques will soon become critical for all Gambling Services Providers, including Casinos. Failure to comply could leave your business exposed to significant financial and administrative sanctions.

Casinos have historically been at risk of exploitation by those seeking to launder criminal property. We look at five things you need to know about the problem, rules and changes to sector guidance.

1. Why is this important?

The nature of services and products offered by the gambling industry can make it attractive to criminals seeking to launder or disguise the origins of criminally derived funds. Significant risk factors in this industry include the prevalence of cash transactions, accessibility to multiple premises and anonymity on the part of the customer.

2. Who is covered by the rules?

When lawyers representing the casino operator told the NSW Casino Inquiry that there was a good chance criminals used the properties to launder money, it was a further nail in the coffin. Methods of money laundering. Money laundering is an extremely broad crime that can occur in countless different ways. In Nevada, one of the most common money laundering schemes involves using casinos. Reno NV criminal defense attorney Michael Becker gives an example: Example: Sam robs a store in Henderson and takes $10,000 from the register. Casino Money Laundering Was Out of Control, Cullen Commission Hears Some of the instances mentioned in the reports show that a single casino high roller was able to introduce a buy-in amounting to CA$900,000 in cash. This happened over the course of one day and casino management saw nothing suspicious about it. In addition to the civil money penalty, the casino is required to conduct periodic external audits to examine its anti-money laundering (AML) BSA compliance program and provide those audit reports to FinCEN and the casino's Board of Directors.

New anti-money laundering provisions relating to casinos were brought in by the Money Laundering Regulations 2017 (MLR 2017) on 26 June 2017. A key change is that all casino operators, both remote and non-remote, are now caught by MLR 2017, rather than simply holders of a casino operating licence. A remote casino operator will be caught by the MLR 2017 if they have at least one piece of remote gambling equipment situated in the UK or if the gambling facilities provided by the remote casino are used in the UK.

This means that non-casino gambling providers, such as betting shops, are not covered by the MLR 2017.

3. What are the rules?

Under the MLR 2017, casino operators have a legal obligation to do the following: Igt slot machines how to clear codes.

- Risk assessment: conduct a written risk assessment in respect of money laundering risks faced by the business and ensure that there are adequate procedures in place to deal with those risks.

- Customer due diligence: conduct risk based customer due diligence (CDD) when they:< >establish a business relationshipsuspect money laundering or terrorist financingdoubt the veracity or adequacy of documents or information previously obtained for the purposes of identification or verification.Nominated officer: appoint a member of the firm as their nominated officer (i.e. outsourcing is no longer possible) as well as a member of the board of directors (or equivalent) as the officer responsible for compliance.

- Reliance on third parties: accept ultimate responsibility for compliance with MLR 2017, even where they are entitled to rely on CDD carried out by third parties.

In July 2010, the Gambling Commission, which oversees the casino industry's compliance with their anti-money laundering obligations, published a guidance note entitled 'Money laundering: the prevention of money laundering and combating the financing of terrorism: Guidance for remote and non-remote casinos' (PDF). This guidance was updated in 2011 and 2016 following changes in the law.

4. How are the rules/guidance changing?

In light of the changes brought about by the MLR 2017, and also the Criminal Finances Act 2017, the Gambling Commission's guidance note has been revised to a new fourth edition to assist casino operators in complying with the latest requirements. The updated guidance went out to consultation in July 2017. Responses are sought by 8 September 2017.

Casino Money Laundering Explained

The consultation document invites feedback on the above amendments and, in addition, asks for views on whether or not the Gambling Commission should remain the sole supervisory authority for money service business activities provided by non-remote casinos.

5. What can casino operators do to comply with the amended regulations?

Casino operators can ensure they have effective anti-money-laundering and counter-terrorist financing measures in place by taking the following steps:

- Risk assessment: review and revise the risk assessment, covering issues such as customer profile, premises and remote sites and incidents of actual or suspected attempted money laundering.

- Policies and procedures: review and revise policies and procedures in light of the identified risks. Ensure that the policies and procedures are properly disseminated and appropriate training is provided on them to front line staff.

- Senior management commitment: senior management must be fully engaged in developing and maintaining procedures and controls which are necessary to manage the risks identified in the casino operator's risk assessment.

- Record keeping: keep records of all anti-money-laundering policies, procedures and controls and all ongoing transactions with customers. Records of CDD identification and verification must be maintained for at least 5 years.

- Suspicious activity reports: providing appropriate training to all relevant employees to enable them to make a report where they know, suspect (or have reasonable grounds to know or suspect) that a person is engaged in actual or attempted money laundering or terrorist financing.

Is your casino operating in the European Union or in one of the OECD Country?

Most of OECD Countries, including EU, USA, Canada, and Australia have adopted Anti Money Laundering Law.

European Union IV Directive EU 2015/849 about the prevention of the use of the financial system for the purposes of money laundering introduced an incumbent compliance requirement and very soon all National Governments of EU Countries will adopt a National Law to enforce European Union Directive and therefore all casinos must be compliant to AML Law.

Having a robust AML strategy and procedure and/or better installing a technological integrated system to detect and prevent Money Laundering illegal activities, methods and techniques will soon become critical for all Gambling Services Providers, including Casinos. Failure to comply could leave your business exposed to significant financial and administrative sanctions.

Casino Money Laundering

GTI Gaming is therefore pleased and proud to announce and inform all casinos owners and executives that GTI designed, implemented and developed specific AML functions and features of its Casino CIMS System, in order to be fully equipped to ensure that all reasonable steps are taken to prevent, detect and report suspicious activity relating to money laundering, terrorist financing, and other financial crimes and to comply with the upcoming IV EU AML Directive, over all the other well known functions and features offered by GTI system.

Casino CIMS System 2.0 – AML compliance menu: features and functions

Player identification

Player casino chips transaction tracking and reporting

Player suspicious transaction alert and reporting

If you wish to know more about please contact us.